Casual Info About How To Appeal Property Tax Michigan

This is available from the.

How to appeal property tax michigan. 23 hours agoproperty tax assessments determine the property value, which is performed by a government assessor who then uses this assessment to calculate the amount of taxes due. How to appeal property taxes in michigan. Homeowners in michigan are assessed every year by a local tax assessor.

Start your appeal, get assigned a docket number, you then will need to file a motion to conduct discovery. If you choose to use an agent, provide that person with a written document authorizing their right to appeal on your behalf. Valuation appeal (or property tax appeal) michigan tax tribunal.

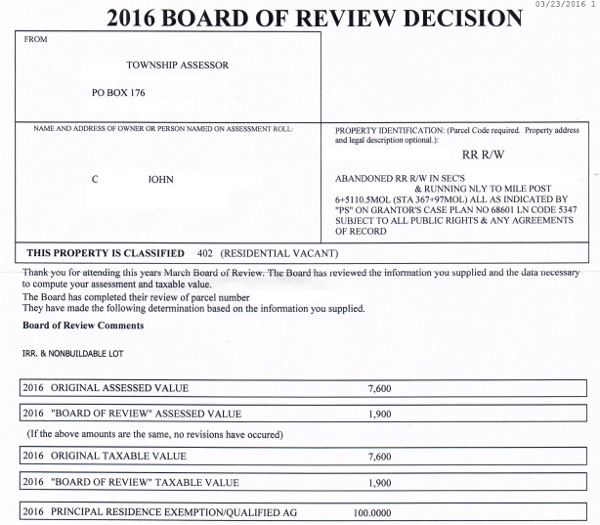

Go to your local assessor’s office and obtain a copy of your appraisal card for your property or visit. The procedures require the taxpayer to appeal to the board of assessors review first. The assessment ascertains your home's assessed.

Valuation appeal (or property tax appeal) the property is residential. Step 1you may appeal your taxable value and sev to the march board of review in 2009. How to appeal propertytaxes in michigan.

During downturns in the real estate market, equalized and taxable values may be higher than market prices. In order to appeal an assessment to the michigan tax tribunal, residential property owners must attend the municipality’s local board of review in march. You will recieve a notice of when they.

With many citizens still reeling from the economic downturn caused by the global pandemic, increased property taxes can be a huge issue for. An appearance at the local board of. Board of assessors review can take into account such circumstances as structural defects, fire.

The hearings division is an administrative forum within the michigan department of treasury (department) where a taxpayer may contest certain actions taken by.